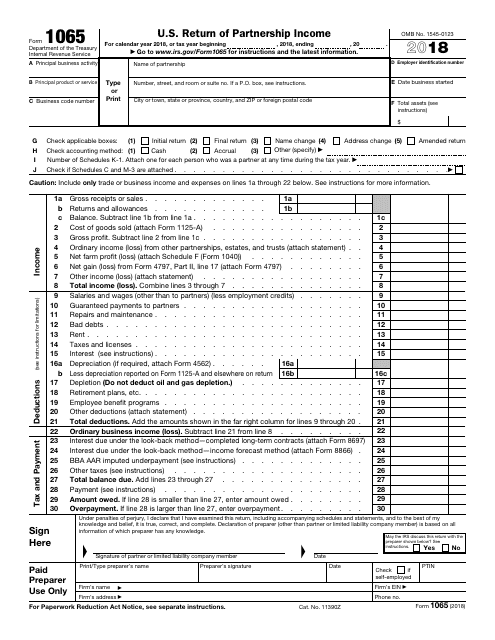

Offset the credit against income tax liability.The credit is allocated and certified by the California Film Commission (CFC). Soundstage Filming Tax Credit – For taxable years beginning on or after January 1, 2022, R&TC Sections 23698(k) allows a fourth film credit, the Soundstage Filming Tax Credit against tax. R&TC Sections 17024.1.5 have been amended to clarify that, unless otherwise expressly disallowed, federal elections made before a taxpayer becomes a California taxpayer are binding for California tax purposes. Taxpayers should not consider the instructions as authoritative law. It is not possible to include all requirements of the California Revenue and Taxation Code (R&TC) in the instructions. We include information that is most useful to the greatest number of taxpayers in the limited space available. The instructions provided with California tax forms are a summary of California tax law and are only intended to aid taxpayers in preparing their state income tax returns. 1001, Supplemental Guidelines to California Adjustments, the instructions for California Schedule CA (540), California Adjustments – Residents, or Schedule CA (540NR), California Adjustments – Nonresidents or Part-Year Residents, and the Business Entity tax booklets. Additional information can be found in FTB Pub. For more information, go to ftb.ca.gov and search for conformity. When California conforms to federal tax law changes, we do not always adopt all of the changes made at the federal level. However, there are continuing differences between California and federal law.

In general, for taxable years beginning on or after January 1, 2015, California law conforms to the Internal Revenue Code (IRC) as of January 1, 2015. References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC). 2022 Instructions for Form 565, Partnership Return of Income

0 kommentar(er)

0 kommentar(er)